Market Outlook

January 17, 2018

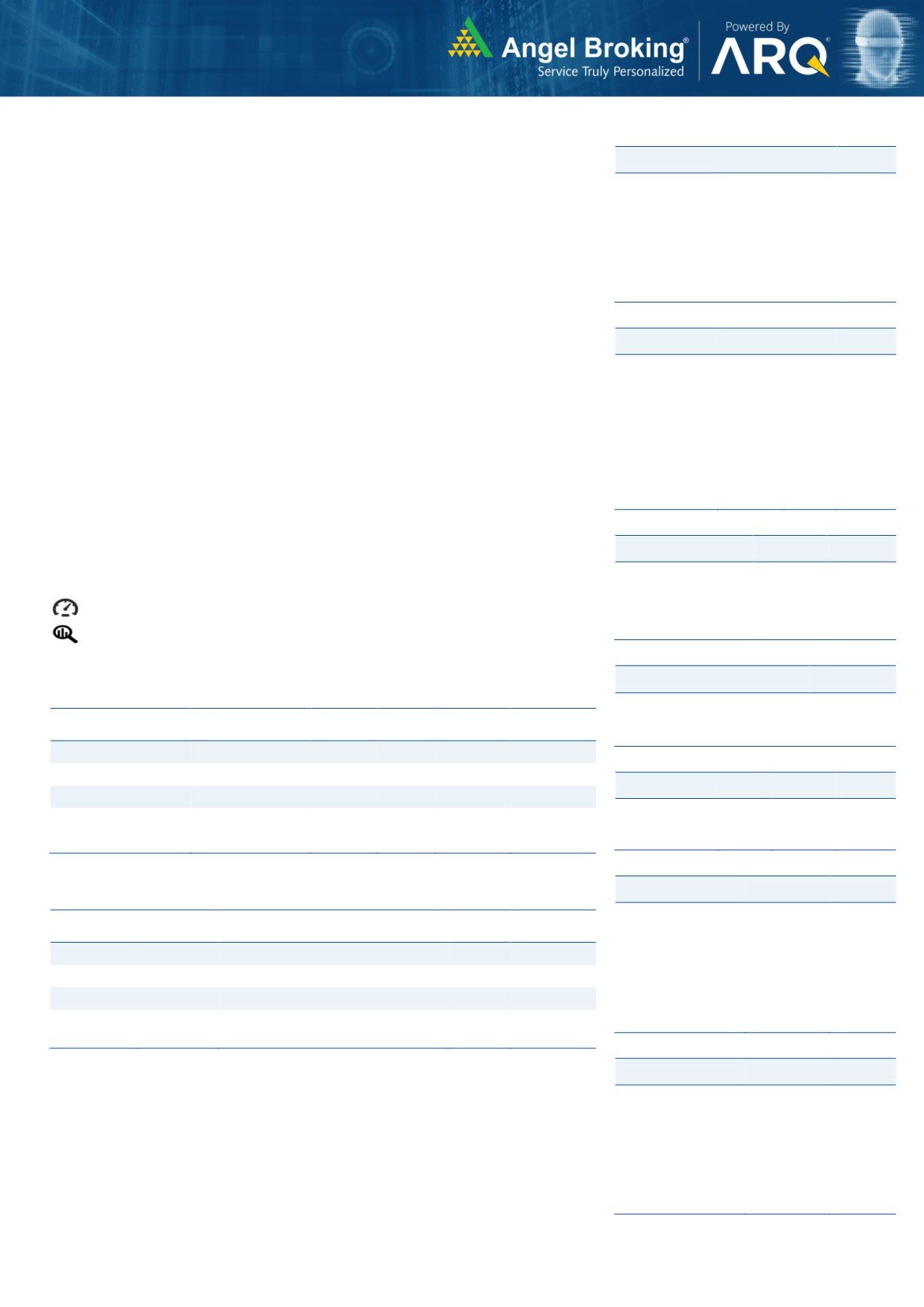

Market Cues

Domestic Indices

Chg (%)

(Pts)

(Close)

Indian markets are likely to open flat tracking global indices and SGX Nifty.

BSE Sensex

(0.2)

(72)

34,771

US stocks turned lower over the course of the trading session. The major averages

Nifty

(0.4)

(41)

10,700

reached record intraday highs early in the day but eventually closed in negative

Mid Cap

(1.7)

(315)

17,814

territory.The Dow Jones ended on a flat note at 25,793 and the Nasdaq Composite

Small Cap

(2.2)

(444)

19,603

edged down to 0.5%, to 7,224.

Bankex

(0.4)

(106)

29,356

U.K. shares were little changed as investor awaited U.K. inflation data due later in

the day for direction. The FTSE 100 was down by 0.2% to close at 7,756.

Global Indices

Chg (%)

(Pts)

(Close)

Dow Jones

(0.0)

(10)

25,793

On domestic front, Indian shares ended slightly lower as concerns over widening

Nasdaq

(0.5)

(37)

7,224

fiscal deficit and rising oil prices offset investor optimism over corporate earnings.

The Sensex dropped to 0.2% at 34,771 while the Nifty ended at 10,700 with an

FTSE

(0.2)

(13)

7,756

downside of 0.4%.

Nikkei

(0.4)

(97)

23,855

Hang Seng

(0.4)

(117)

31,788

News Analysis

Shanghai Com

0.7

24

3,460

TCS signs $690 million deal with Prudential Plc's unit

Detailed analysis on Pg2

Advances / Declines

BSE

NSE

Advances

735

340

Investor’s Ready Reckoner

Declines

2,264

1,491

Key Domestic & Global Indicators

Unchanged

110

40

Stock Watch: Latest investment recommendations on 150+ stocks

Refer Pg5 onwards

Volumes (` Cr)

Top Picks

BSE

7,663

CMP

Target

Upside

Company

Sector

Rating

(`)

(`)

(%)

NSE

38,603

Blue Star

Capital Goods Accumulate

757

867

14.5

Dewan Housing Finance

Financials

Buy

602

712

18.3

Net Inflows (` Cr)

Net

Mtd

Ytd

Asian Granito

Other

Accumulate

589

651

10.5

FII

153

1,763

1,763

Navkar Corporation

Other

Buy

204

265

30.2

*MFs

278

2,520

2,520

KEI Industries

Capital Goods Accumulate

401

436

8.9

More Top Picks on Pg4

Top Gainers

Price (`)

Chg (%)

Key Upcoming Events

Previous

Consensus

Justdial

638

5.3

Date

Region

Event Description

Reading

Expectations

Wipro

332

4.9

Jan17

Euro Zone Euro-Zone CPI (YoY)

1.40

1.40

Hcltech

949

4.6

Jan17

US

Initial Jobless claims

261.00

250.00

Infy

1,123

3.9

Jan18

US

Industrial Production

0.20

0.40

Jan18

US

Housing Starts

1,297.00

1,275.00

Tcs

2,851

3.8

Jan18

China

Real GDP (YoY)

6.80

6.70

More Events on Pg7

Top Losers

Price (`)

Chg (%)

Gnfc

485

(10.2)

Icil

121

(8.9)

Nationalum

79

(8.4)

Equitas

152

(7.6)

Federalbnk

105

(7.5)

As on January 16, 2018

Market Outlook

January 17, 2018

News Analysis

TCS signs $690 million deal with Prudential Plc's unit

Tata Consultancy Services India's largest IT services company, signed for $690

million deal with M&G Prudential, the UK and European savings and investments

business unit of Prudential Plc, to digitally transform their business and deliver

enhanced service for its UK savings and retirement customers.

This agreement is over 10 years and covers the support of over 4 million customer

policies. TCS will also assume responsibility for the operation of some of

Prudential's internal IT infrastructure to enable the IT operations function to deliver

greater flexibility in the provision of services to the businesses within the Prudential

Group.

Economic and Political News

After Qatar and Australia, GAIL India gets Russia to lower LNG import price

Centre plans to invest Rs 107bn to boost telecommunication in north east

Black money fight: Centre to deregister 120,000 firms for non-compliance

Global IT spending to hit $3.7 trillion in 2018 on AI, blockchain boost

Corporate News

Nalco seeks approval for Pottangi bauxite mining lease in Koraput

TCS wins $690mn deal with UK's M&G Prudential; second deal this year

Volkswagen Group evaluating fresh investments for new products in India

RIL to invest Rs 50bn in Bengal; to get 100% Jio coverage by December

Market Outlook

January 17, 2018

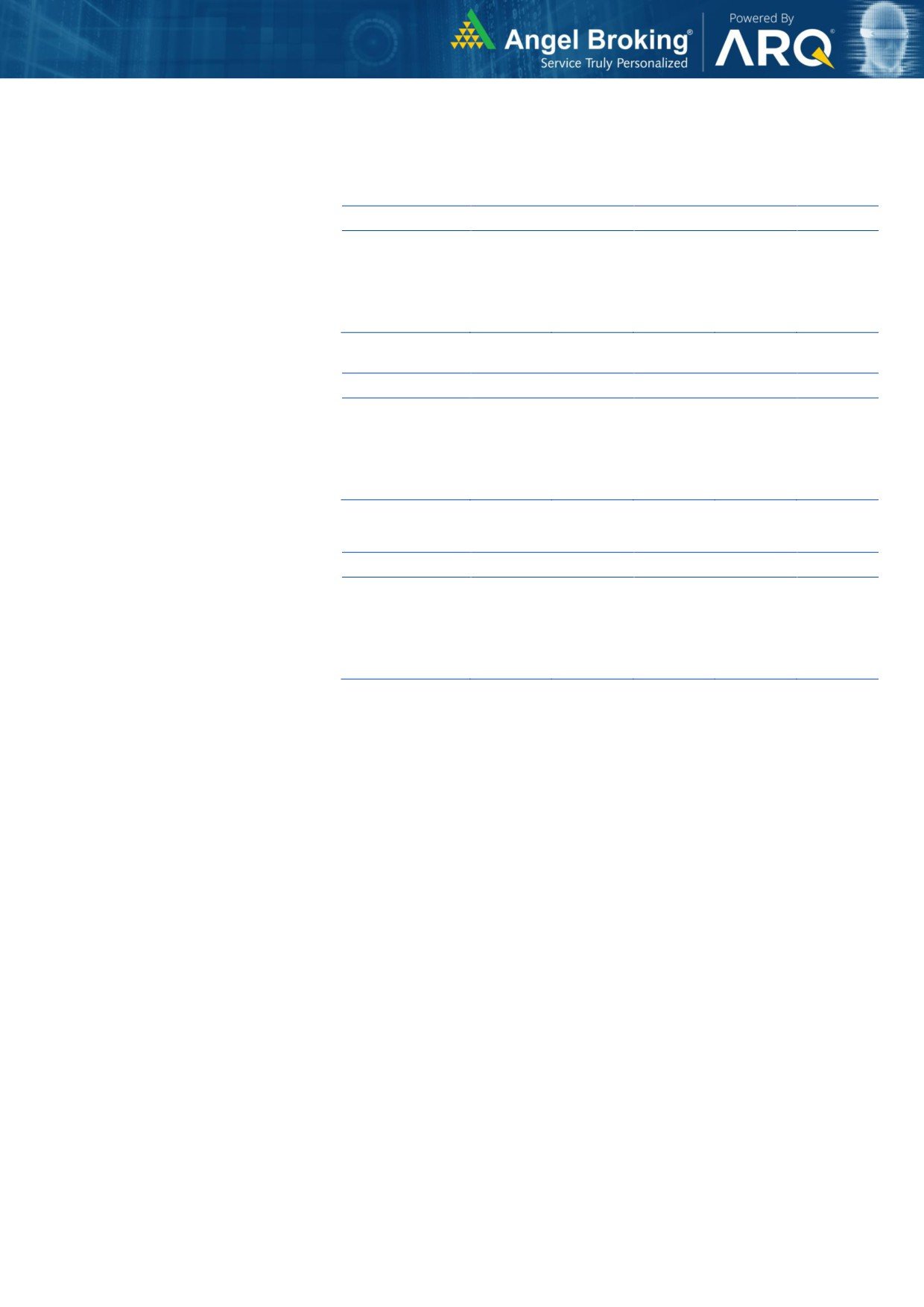

Quarterly Bloomberg Brokers Consensus Estimate

Hindustan Unilever Ltd - Jan 17, 2018

Particulars ( ` cr)

3QFY18E

3QFY17

y-o-y (%)

2QFY18

q-o-q (%)

Sales

8239

7706

6.9

8309

(0.8)

EBIDTA

1701

1350

26.0

1672

1.7

%

20.6

17.5

20.1

PAT

1212

1038

16.8

1276

(5.0)

Zee Entertainment - Jan 17, 2018

Particulars ( ` cr)

3QFY18E

3QFY17

y-o-y (%)

2QFY18

q-o-q (%)

Sales

1748

1639

6.6

1582

10.5

EBIDTA

570

440

29.5

476.4

19.6

%

32.6

26.9

30.1

PAT

400

250.8

59.5

590.8

(32.9)

Bharti Infratel - Jan 17, 2018

Particulars ( ` cr)

3QFY18E

3QFY17

y-o-y (%)

2QFY18

q-o-q (%)

Sales

3645

1530

138.2

1658.7

119.8

EBIDTA

1578

705.6

123.8

789.8

99.7

%

43.2

46.1

47.6

PAT

707

620.4

14.01

638.4

10.7

Market Outlook

January 17, 2018

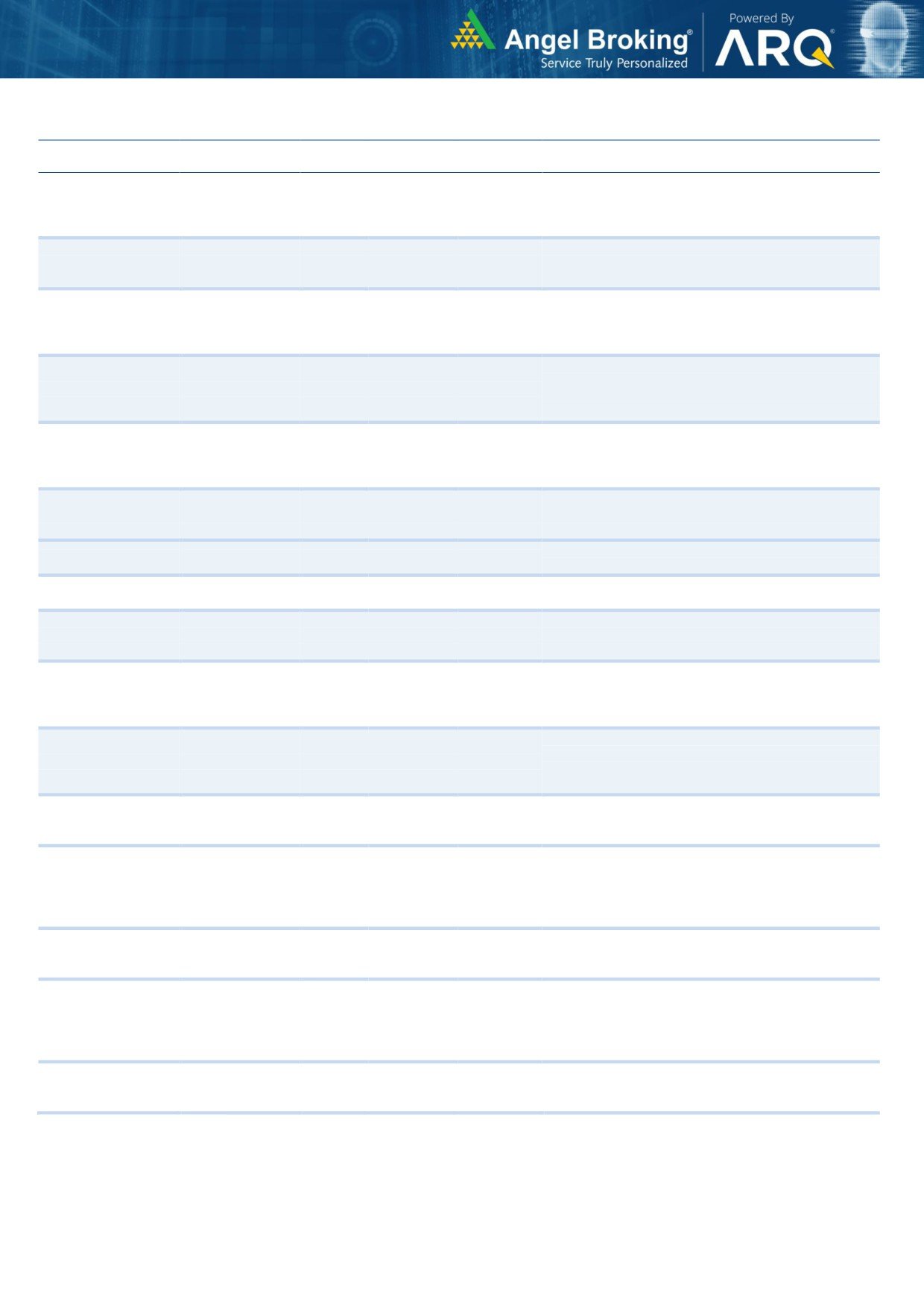

Top Picks

Market Cap

CMP

Target

Upside

Company

Rationale

(` Cr)

(`)

(`)

(%)

Strong growth in domestic business due to its

leade`hip in acute therapeutic segment. Alkem expects

Alkem Laboratories

27,219

2,277

2,441

7.2

to launch more products in USA, which bodes for its

international business.

We expect the company would report strong

Asian Granito

1,773

589

651

10.5

profitability owing to better product mix, higher B2C

sales and amalgamation synergy.

Favorable outlook for the AC industry to augur well for

Cooling products business which is out pacing the

Blue Star

7,260

757

867

14.5

market growth. EMPPAC division's profitability to

improve once operating environment turns around.

With a focus on the low and medium income (LMI)

consumer segment, the company has increased its

Dewan Housing Finance

18,884

602

712

18.3

presence in tier-II & III cities where the growth

opportunity is immense.

Loan growth is likely to pick up after a sluggish FY17.

Lower credit cost will help in strong bottom-line

Karur Vysya Bank

8,863

122

160

31.1

growth. Increasing share of CASA will help in NIM

improvement.

High order book execution in EPC segment, rising B2C

KEI Industries

3,138

401

436

8.9

sales and higher exports to boost the revenues and

profitability

Expected to benefit from the lower capex requirement

Music Broadcast

2,368

415

475

14.4

and 15 year long radio broadcast licensing.

Massive capacity expansion along with rail advantage

Navkar Corporation

3,064

204

265

30.2

at ICD as well CFS augur well for the company

Strong brands and distribution network would boost

Siyaram Silk Mills

3,588

766

851

11.2

growth going ahead. Stock currently trades at an

inexpensive valuation.

Market leadership in Hindi news genre and no. 2

viewership ranking in English news genre, exit from the

TV Today Network

2,574

432

500

15.9

radio business, and anticipated growth in ad spends

by corporate to benefit the stock.

After GST, the company is expected to see higher

volumes along with improving product mix. The

Maruti Suzuki

2,81,554

9,321

10,619

13.9

Gujarat plant will also enable higher operating

leverage which will be margin accretive.

We expect loan book to grow at 24.3% over next two

GIC Housing

2,380

442

655

48.2

year; change in borrowing mix will help in NIM

improvement

We expect CPIL to report net Revenue/PAT CAGR of

~17%/16% over FY2017-20E mainly due to healthy

7,744

349

400

14.8

growth in plywood & lamination business, forayed into

Century Plyboards India

MDF & Particle boards on back of strong brand &

distribution network.

We expect sales/PAT to grow at 13.5%/20% over next

LT Foods

3,109

97

128

31.7

two years on the back of strong distribution network &

addition of new products in portfolio.

We expect sales/PAT to grow at 13%/16% over next

two years on the back of strong healthy demand in

Ruchira Papers

459

205

244

19.1

writing & printing paper and Kraft paper. Further,

China had banned making paper from waste pulp

which would benefit Indian paper companies.

We expect financialisation of savings and increasing

Aditya Birla Capital

39781

181

230

27.0

penetration in Insurance & Mutual fund would ensure

steady growth.

Source: Company, Angel Research

Market Outlook

January 17, 2018

Fundamental Call

Market Cap

CMP

Target

Upside

Company

Rationale

(` Cr)

(`)

(`)

(%)

CCL is likely to maintain the strong growth trajectory

CCL Products

3,956

297

360

21.1

over FY18-20 backed by capacity expansion and new

geographical foray

We forecast Nilkamal to report top-line CAGR of ~9%

to `2,635cr over FY17-20E on the back of healthy

Nilkamal

2,844

1,906

2,178

14.3

demand growth in plastic division. On the bottom-line

front, we estimate ~10% CAGR to `162cr owing to

improvement in volumes.

We expect sales/PAT to grow at 9%/14% over next two

years on the back of healthy demand growth in

Shreyans Industries

292

211

247

16.9

printing. Further, China had banned making paper

from waste pulp which would benefit Indian paper

companies.

The prism has diversified exposure in the different

segment such as Cement, Tile & ready mix concrete.

Prism Cement

7,482

149

160

7.6

Thus we believe, PCL is in the right place to capture

ongoing government spending on affordable housing

and infrastructure projects.

Source: Company, Angel Research

Market Outlook

January 17, 2018

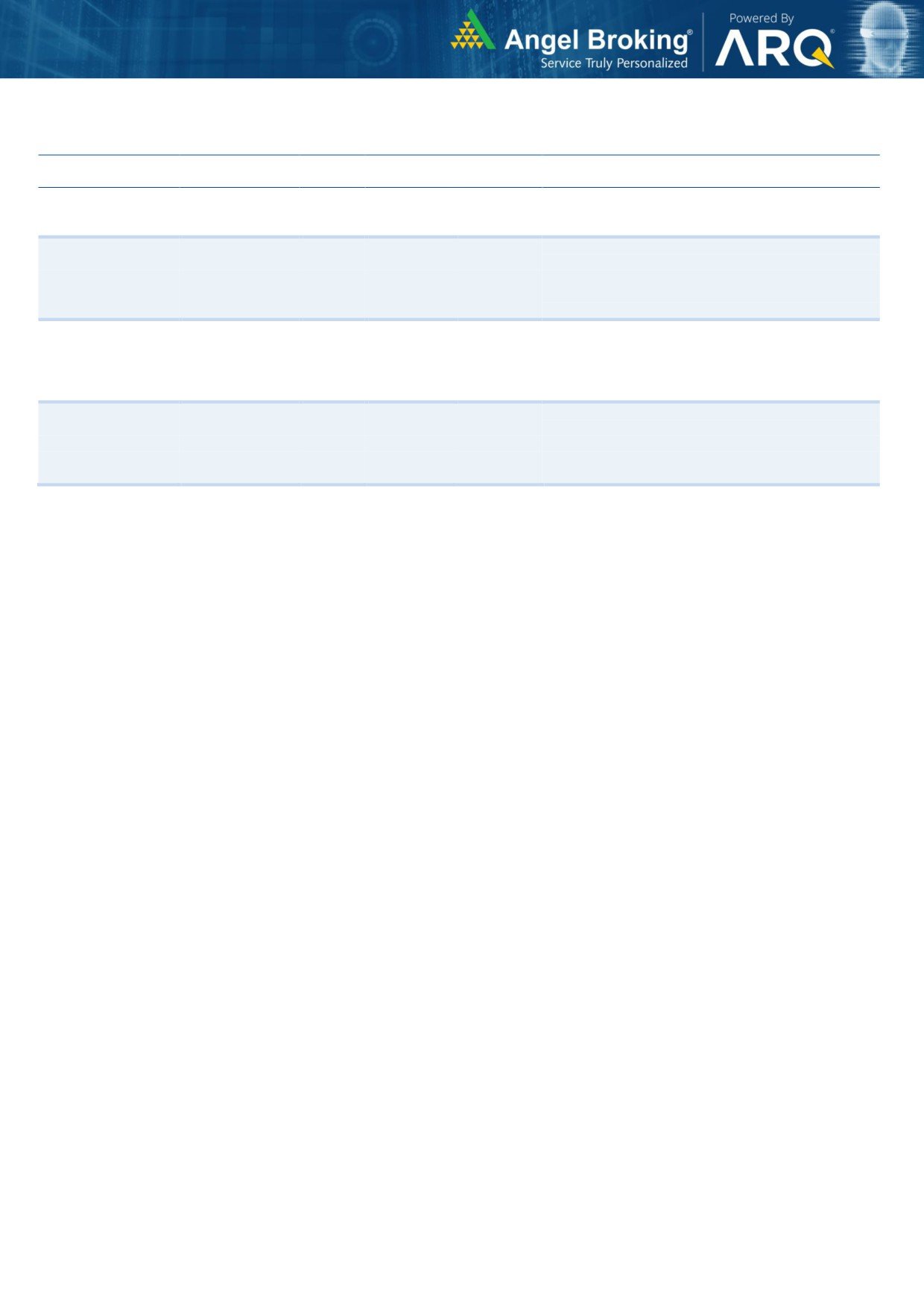

Key Upcoming Events

Result Calendar

Date

Company

January 17, 2018

Hindustan Unilever, Zee Electronic, Infratel

January 18, 2018

UltraTech Cement, Infotech Enterprises, D B Corp, Hind. Zinc

Source: Bloomberg, Angel Research

Global economic events release calendar

Bloomberg Data

Date

Time

Country

Event Description

Unit

Period

Last Reported

Estimated

Jan 16, 2018

12:00 PMIndia

Monthly Wholesale Prices YoY%

% Change

Dec

3.58

4.00

Jan 17, 2018

3:30 PMEuro Zone Euro-Zone CPI (YoY)

%

Dec F

1.40

1.40

7:00 PMUS

Housing Starts

Thousands

Dec

1,297.00

1,275.00

Jan 18, 2018

7:45 PMUS

Industrial Production

%

Dec

0.20

0.40

7:00 PMUS

Initial Jobless claims

Thousands

Jan 13

261.00

250.00

7:00 PMUS

Building permits

Thousands

Dec

1,303.00

1,290.00

12:30 PMChina

Industrial Production (YoY)

% Change

Dec

6.10

6.10

12:30 PMChina

Real GDP (YoY)

% Change

4Q

6.80

6.70

Jan 23, 2018

8:30 PMEuro Zone Euro-Zone Consumer Confidence

Value

Jan A

0.50

Jan 24, 2018

2:00 PMGermany PMI Services

Value

Jan P

55.80

2:00 PMGermany PMI Manufacturing

Value

Jan P

63.30

8:30 PMUS

Existing home sales

Million

Dec

5.81

5.65

3:00 PMUK

Jobless claims change

% Change

Dec

5.90

Jan 25, 2018

8:30 PMUS

New home sales

Thousands

Dec

733.00

667.50

3:00 PMUK

GDP (YoY)

% Change

4Q A

1.70

Source: Bloomberg, Angel Research

Market Outlook

January 17, 2018

Macro watch

Exhibit 1: Quarterly GDP trends

Exhibit 2: IIP trends

(%)

(%)

10.0

9.0

8.4

9.1

9.0

8.0

8.0

7.9

7.0

7.6

7.5

8.0

7.3

7.2

7.0

6.0

4.8

7.0

6.3

5.0

4.4

4.1

6.1

6.1

5.7

3.5

3.2

6.0

4.0

2.9

3.0

2.0

5.0

2.0

1.2

1.0

4.0

1.0

-

3.0

(1.0)

(0.3)

Source: CSO, Angel Research

Source: MOSPI, Angel Research

Exhibit 3: Monthly CPI inflation trends

Exhibit 4: Manufacturing and services PMI

56.0

Mfg. PMI

Services PMI

(%)

6.0

54.0

5.2

4.9

52.0

5.0

3.9

50.0

3.7

3.6

4.0

3.3

3.3

3.2

3.0

48.0

3.0

2.4

2.2

46.0

2.0

1.5

44.0

1.0

42.0

40.0

-

Source: Market, Angel Research; Note: Level above 50 indicates expansion

Source: MOSPI, Angel Research

Exhibit 5: Exports and imports growth trends

Exhibit 6: Key policy rates

(%)

Exports yoy growth

Imports yoy growth

(%)

Repo rate

Reverse Repo rate

CRR

60.0

6.50

50.0

6.00

40.0

5.50

30.0

5.00

20.0

4.50

10.0

4.00

0.0

3.50

(10.0)

3.00

Source: Bloomberg, Angel Research

Source: RBI, Angel Research

Market Outlook

January 17, 2018

Global watch

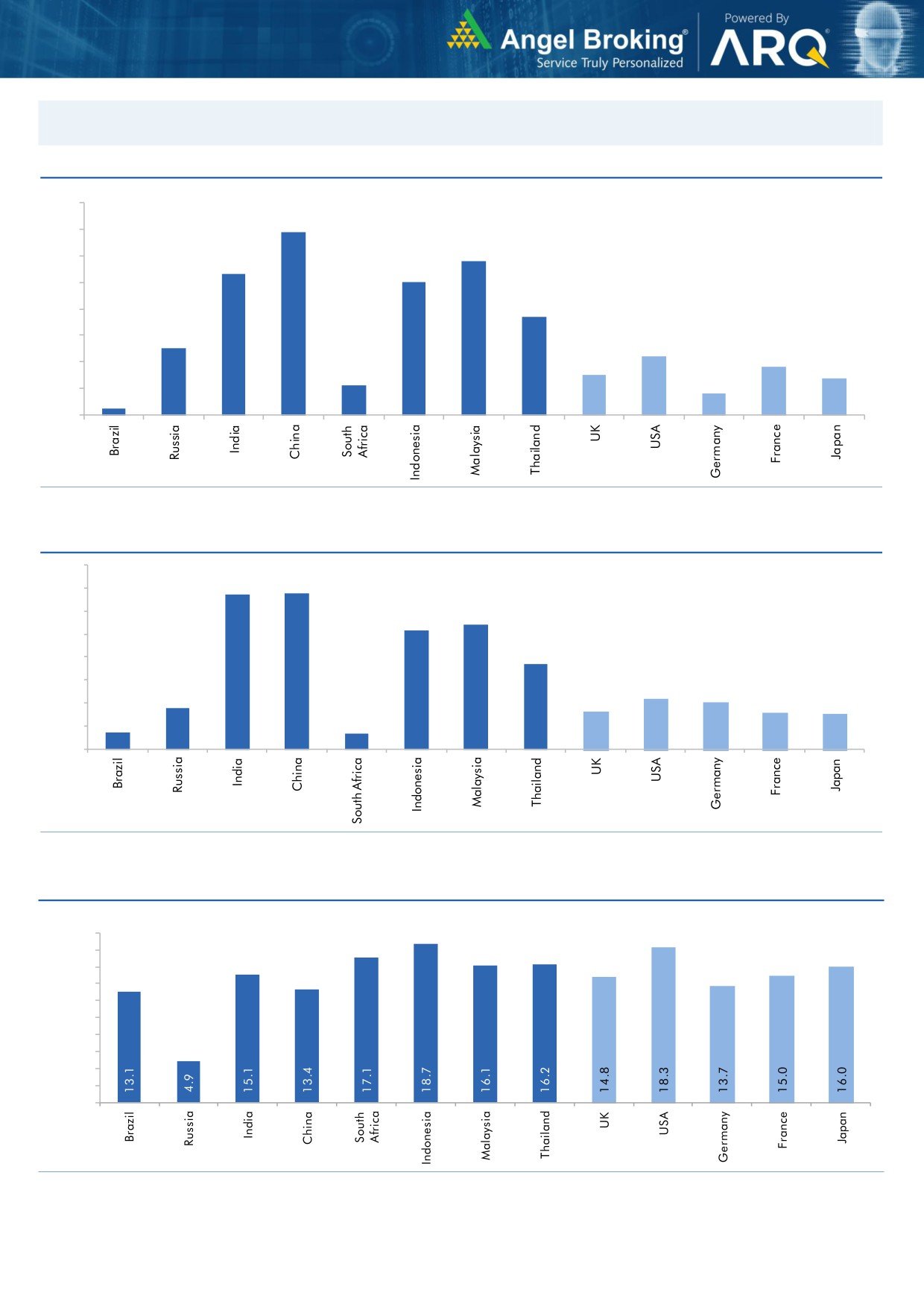

Exhibit 1: Latest quarterly GDP Growth (%, yoy) across select developing and developed countries

(%)

8.0

6.9

7.0

5.8

6.0

5.3

5.0

5.0

1.1

3.7

4.0

2.5

3.0

2.2

1.8

2.0

1.5

1.4

0.8

1.0

0.3

-

Source: Bloomberg, Angel Research

Exhibit 2: 2017 GDP Growth projection by IMF (%, yoy) across select developing and developed countries

(%)

6.7

6.8

7.0

6.0

5.4

5.2

5.0

3.7

4.0

3.0

1.8

2.2

2.0

1.7

1.6

2.0

0.7

1.5

0.7

1.0

-

Source: IMF, Angel Research

Exhibit 3: One year forward P-E ratio across select developing and developed countries

(x)

20.0

18.0

16.0

14.0

12.0

10.0

8.0

6.0

4.0

2.0

-

Source: IMF, Angel Research

Market Outlook

January 17, 2018

Exhibit 4: Relative performance of indices across globe

Returns (%)

Country

Name of index

Closing price

1M

3M

1YR

Brazil

Bovespa

79,832

8.2

5.4

29.4

Russia

Micex

2,258

4.5

7.8

3.1

India

Nifty

10,700

4.4

4.6

27.3

China

Shanghai Composite

3,437

6.0

2.4

9.2

South Africa

Top 40

53,778

4.8

4.5

16.7

Mexico

Mexbol

49,492

2.5

(1.3)

8.2

Indonesia

LQ45

1,093

6.9

10.7

23.0

Malaysia

KLCI

1,826

5.1

4.1

9.0

Thailand

SET 50

1,187

7.5

9.9

20.6

USA

Dow Jones

25,793

5.3

12.9

30.1

UK

FTSE

7,756

3.4

2.9

7.0

Japan

Nikkei

23,952

4.4

15.0

24.1

Germany

DAX

13,246

0.5

2.0

14.8

France

CAC

5,514

1.6

3.0

13.7

Source: Bloomberg, Angel Research p68in4

Market Outlook

January 17, 2018

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India

Limited,Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with

CDSL and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or

co-managed public offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and

risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.